guvendemir/E+ through Getty Photos

Funding Thesis

Amidst powerful competitors within the aerospace and protection business, RADA Digital Industries Ltd (NASDAQ:RADA) emerges as a excessive development protection inventory. The corporate’s top quality merchandise have confirmed to be helpful within the discipline and has since gained a robust popularity amongst completely different protection firms and militaries. With fixed demand for its merchandise in addition to promising alternatives to develop, there’s a nice purchase alternative for RADA’s inventory.

Enterprise Overview

Based mostly in Israel, RADA Digital Industries Ltd. is a protection know-how firm that develops, manufactures, and sells protection digital merchandise to completely different governments and firms world wide. Their enterprise is primarily by means of the sale of two completely different product strains: land-based tactical radars and navy avionic gadgets.

Land-Based mostly Tactical Radars

These tactical radars have many functions within the discipline reminiscent of protection power safety and important infrastructure safety. They’re compact, totally digital, very dependable, and cellular. The radars transfer with fight items within the discipline and provides real-time data of any threats and how you can evade them. RADA has developed two completely different radar {hardware} platforms: the compact hemispheric radar, or CHR, and the multi-mission hemispheric radar, or MHR. The CHR is especially used for short-range air surveillance and perimeter/border safety. It helps to determine any aerial and floor intruders in addition to any threats which may be fired at fight automobiles. The MHR is especially used for 3-D perimeter surveillance and hostile hearth detection. These radars assist to determine various kinds of aerial automobiles in addition to find threats to mobilized forces. At present, among the major prospects for RADA’s radars are Boeing (BA), Lockheed Martin (LMT), U.S. Marine Corps and Navy, U.S. Air Power, and the Indian Safety Forces.

Navy Avionics

For the previous 25 years, RADA has developed and fielded a variety of navy avionic gadgets reminiscent of digital recorders, cameras, and debriefing programs for navy and aerospace functions. The adaptability and compatibility of the avionic gadgets work properly with any new navy aircrafts and UAVs worldwide. RADA’s navy avionics are at the moment operated by many large navy forces and firms such because the Israeli Air Power, Lockheed Martin, the Chilean Air Power, and the Boeing Firm.

Trade Evaluation

The aerospace and protection market consists of salves of aircrafts, weapons, radar, and navy gear. This business is anticipated to develop from $700.30 billion in 2021 to $1047.07 billion in 2026 with a compound annual development price of 8.5%. The market is especially pushed by investments within the aerospace and protection sector from governments and militaries. The current COVID pandemic has put a restraint on the business as provide chain disruptions led to commerce restrictions and manufacturing delays. Nevertheless, the aerospace and protection market is recovering in a short time and can proceed its excessive development prospects.

The competitors on this business is hard internationally. Large gamers within the house embody The Boeing Firm, Lockheed Martin Company, Normal Dynamics Company (GD), and Raytheon Applied sciences (RTX). Additionally, rules on this business are very large as firms should always monitor their merchandise and make changes as wanted. The market is especially influenced by the fixed demand to boost and improve the capabilities of their product portfolios. This leads to fixed excessive prices which can be put in direction of R&D to repeatedly develop extra subtle product choices, which makes it onerous for brand new firms to realize a big market share.

Aggressive Benefit

In comparison with its rivals reminiscent of Raytheon Applied sciences, Elbit Methods (ESLT) and Honeywell Worldwide (HON), RADA lacks in measurement, abundance of assets, and market share. Nevertheless, there are a few benefits for RADA that assist the corporate develop among the many powerful competitors. Firstly, RADA is the market chief in mini tactical radars and this declare was supported by the U.S. Army once they included RADA of their counter UAS programs. This declare has helped RADA acquire market share, which is essential for the corporate’s future development. Secondly, the corporate has a document of efficiently successful contracts with main prospects just like the U.S. Air Power, and the U.S. Marine Corps. Lastly, its radar programs are considerably lighter than these of their rivals, making it simpler to maneuver and simpler on fight automobiles.

Progress Prospects/Alternatives

RADA Progress Technique

RADA’s final purpose is to be part of massive Division of Protection Packages. The corporate’s extra short-term targets embody constructing a robust popularity for offering high-quality and field-efficient avionics and protection gadgets, establishing a big, secure presence of their major goal markets like the USA, and forming strategic relationships with main integrators in its major goal markets. As the corporate continues to supply its merchandise, it’s already coordinating and dealing with completely different integrators to become involved in numerous initiatives and ultimately change into a part of some Division of Protection Packages.

Enhance Manufacturing

When having a look at RADA’s steadiness sheet, we will see that the change in stock is detrimental, that means that the demand is outgrowing manufacturing. With fixed excessive demand for its navy merchandise, RADA must guarantee that it has sufficient stock to fulfill all of its demand, which poses an important alternative for the corporate to extend manufacturing.

International Attain

One other alternative for RADA is to increase internationally. At present, many of the firm’s gross sales come from the USA and Israel, which make up round 75% of its revenues. If RADA have been to faucet into the militaries of different nations reminiscent of these in Europe and Asia, that will tremendously enhance the corporate’s international affect and market share. At present, the corporate is sending enterprise consultants to those European and Asian nations the place RADA’s gadgets could also be used.

Non-Navy Progress Alternatives

Not too long ago up to now few years, there have been a number of drone assaults or drone disturbances. A few of them embody the drone assault on two Saudi Arabian oil amenities in September of 2019 and the drone recognizing on the runway on the UK Gatwick airport in 2018, resulting in hundreds of canceled flights. These incidents have proven that it might not solely be the navy who wants to make use of RADA’s gadgets. The necessity for anti-drone protection programs turns into stronger as a way to shield residents, vacationers, and staff.

Financials

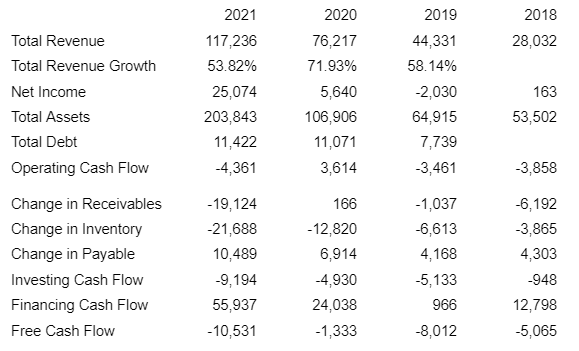

Yahoo Finance

The corporate’s revenues and asset development have been each robust with constant will increase. The aerospace and protection business all the time has fixed demand, which has been one of many essential drivers for RADA’s gross sales. At first thought, when having a look on the firm’s assertion of money circulate, it might appear a bit worrisome to see detrimental free money flows. However I see one thing completely different. When taking a better have a look at the completely different money circulate segments, on the working money circulate, we will see that the change in working capital is detrimental, together with detrimental change in receivables, detrimental change in stock, and optimistic change in payables. This appears to be a sign for development. It exhibits that the corporate should still be investing again into itself for issues like manufacturing and product growth. As well as, we will see from the financing money circulate that the corporate continues to be elevating quite a lot of capital to be put in direction of the expansion of the corporate.

Valuation

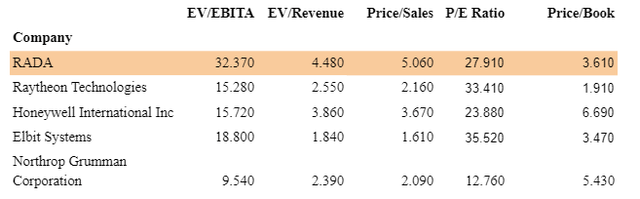

Peer to Peer Evaluation

If we evaluate present valuation metrics of RADA with a few of its rivals, evidently RADA is a bit overvalued. Nevertheless, based mostly on the corporate’s development price up to now few years and its future development projections, RADA appears undervalued.

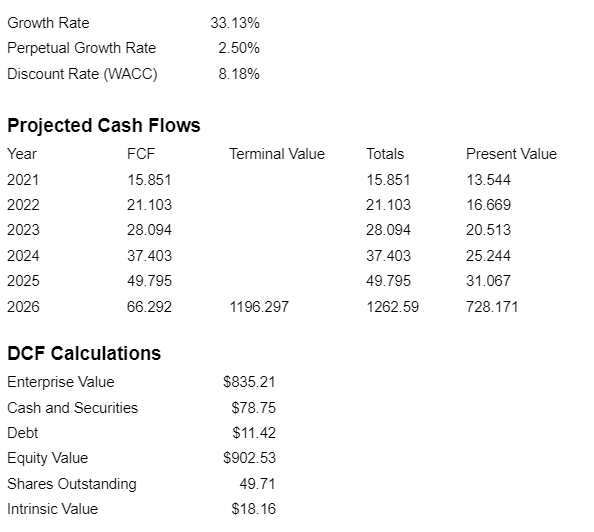

I’ve carried out a reduced money circulate evaluation under. Because the firm is incurring detrimental free money flows, I’ve used EBITA as a proxy without cost money circulate. For the expansion price, I used the RADA’s CAGR based mostly on its development up to now 5 years and the perpetual development price is 2.5%, which is between the historic inflation charges of 2-3% to match the financial system development. Lastly, for the low cost price, I used RADA’s weighted common price of capital.

Calculations performed by creator

Dangers

Fixed Excessive Prices

Because of the extremely aggressive nature of the aerospace and protection business and simply the fixed want for extra superior gear, RADA should constantly make investments some huge cash into R&D and the event of excessive tech navy gadgets. Since RADA is a smaller firm in comparison with its rivals, it might impact its profitability, though the prospect of that’s pretty small, judging by its current surge in web earnings.

Protection Funding Uncertainty

At present, most of RADA’s revenues come from the sale of its navy merchandise. With the USA being its largest goal market, the corporate expects that the U.S. authorities will proceed to position excessive worth on its nationwide safety and proceed to put money into RADA’s merchandise. Nevertheless, there’s nonetheless uncertainty concerning the U.S. protection funding ranges and priorities from the Biden Administration. Any lower in funding or shifts in nationwide priorities would adversely have an effect on the demand for RADA’s merchandise.

Excessive Dependence on a Few Clients

Though RADA has many shoppers from completely different protection firms and militaries world wide, an enormous portion of its revenues comes from a small variety of prospects. In 2021, 49% of its revenues got here from solely 5 prospects. This makes it essential for the corporate to keep up good relationships with the corporate and proceed to ship top quality merchandise. Even the lack of one in every of these key prospects may have a big effect on the corporate’s enterprise as a complete.

Conclusion

I might price RADA as a purchase with a worth goal of $18.16. The corporate has a transparent development technique that it’s at the moment finishing up together with a robust aggressive benefit towards its rivals regardless of its smaller measurement and attain. Within the subsequent three or 4 years, we may even see an enormous flip for RADA because it undergoes its development technique, forming partnerships with completely different integrators and incomes a bigger international market share.